When Customer is also Supplier - Interparty Receivable/ Payable Adjustment

Adjustments of Parties Having Dual Nature

(Same

Party is customer as well as Vendor)

For

Example

1.

ABC

(Customer) Balance Rs. 10,000

2.

ABC(Vendor)

Balance Rs. 15,000

First

adjust Rs.10, 000 of party ABC as a Customer.

First

create an account in chart of account named as “Clearing Account” with (Other payable/Receivable A/C) nature to

adjust the parties balances having customer as well as vendor behavior. But in Quick

Books (QB) /Dynamics AX 2012/D365 it be of Liability type. It will be actually

contra asset/liability account

Go

to “General Ledger” and create new

General Journal and do following entry. Please note don’t forget to mention the

name of respective Customer OR supplier while making Entry.

Clearing

Account A/C (Dr) Rs. 10,000

ABC (Customer) (Cr.) Rs. 10,000

In this way all the balance of customer will be

transferred to Clearing Account.

Note: First transfer that parties’ (Customer/Vendor)

balance having lower balance. Here customer balance is less than vendor.

(10,000<15,000)

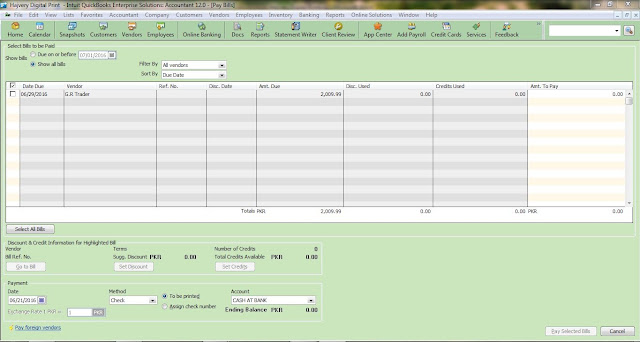

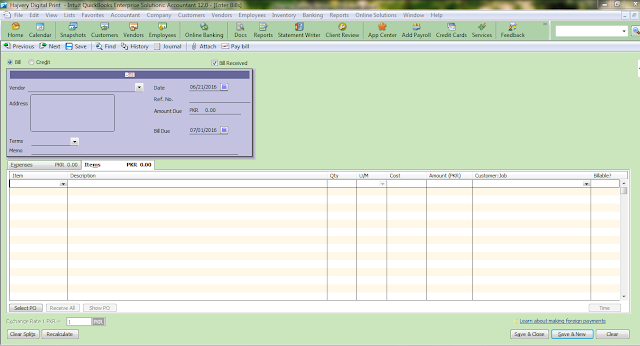

The next entry will

be as follows in Quick books 12.0:

ABC

(Vendor) A/C (Dr) 15,000

Clearing Account A/C (Cr) 10,000

Cash/Bank Ac/C 5,000

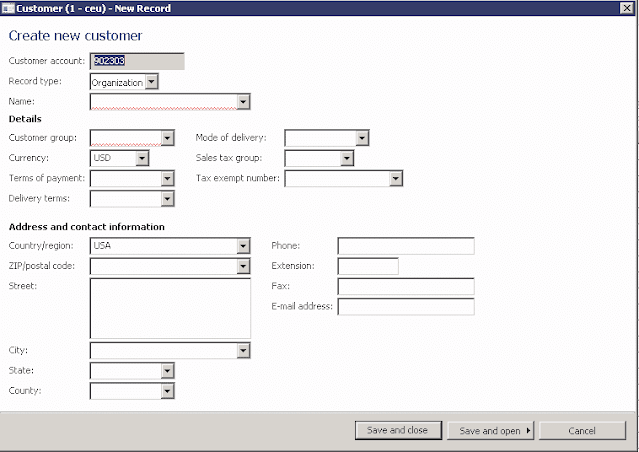

In Microsoft Dynamics

AX 2012/ D 365 these entries will be like way:

1- ABC (Vendor) A/C (Dr) 10,000

Clearing Account A/C

(Cr) 10,000

2-

ABC

(Vendor) A/C (Dr) 5,000

Cash/Bank Ac/C 5,000

Comments

Post a Comment

Thanks for your comment, will get back to you soon.