Recording Sales Returns/Credit Memo in Quick Books

How to record Sales Returns in Quick Books?

How to record Customer Credit Memo?

Follow

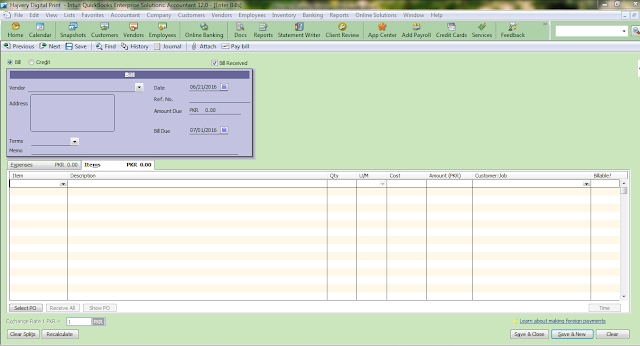

the navigation to open the Credit memo form:

Go

to -> Home page/Customer Tab -> Select Customer Credit Note

This

window will open, follow the steps given below to record customer return.

1.

Select the

customer form the dropdown, you can type to search the respective customer for

posting return.

2.

Select the “Class/Cost

Center” to whom to want to allocate this sales return and related cost

revert.

3.

Address details

will be populated automatically if provided at the time of customer creation

else can be added at the time of return posting.

4.

Select the “Return

Date” and transaction number will be generated automatically with provided

format.

5.

Select the “Item”

or “Service” being returned from “Item Tab” and “Expense

Tab” respectively,

6.

Add description

for memorizing a transaction in later.

7.

Select “Site/Warehouse”

where you want to take stock back, add Quantity returned, Unit of

Measurement “UOM” & Rate/Sale Price at which you want the item/service

returned.

8.

Select the

relevant “Class” and “Tax/Non-Tax” based on taxability of item

either it is taxed at Standard rate, Zero rated or Exempt. If tax charged at

the time of sale then the portion of return will also be recorded to get Net

Sale/VAT Payable.

9.

Add remarks in “Memo”

field related to transaction.

10. Click on “Save & New” or “Save &

Close” to post the transaction.

Comments

Post a Comment

Thanks for your comment, will get back to you soon.