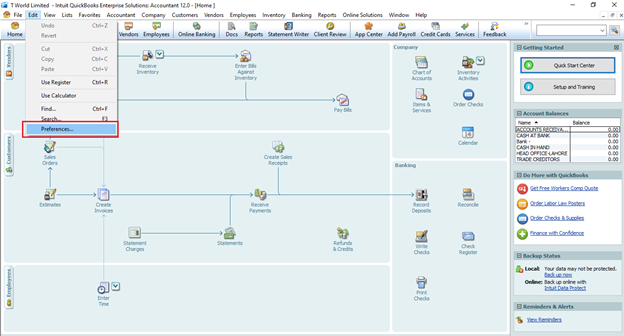

How to account for Foreign Currency Transactions? How to Enable Multicurrency Feature in Quick books (QB 12) 2012 Accounting of Exchange Gain/Loss Customers, Suppliers, Banks having Foreign Currency This blog is about to understand foreign currency transactions and how can we enable it in Quick Books 12. How can we assign currency to a customer, supplier, and bank other than foreign currency? Let’s have a basic overview of it and how accounting is automated in Quick books Enterprise Solution 12.0. Basic Terms to Understand this Concept: Exchange Difference: It is the difference resulting from translating a given number of units of one currency into another currency at different exchange rates. Exchange Rate: It is the ratio of exchange for two currencies. Fair Value: It is the amount for which an asset could be exchanged, or a liability settled, between knowledgeable, willing parties in an arm’s length transaction. Foreign Currency: Currency other than the fu...