How to account for Foreign Currency Transactions?

How

to Enable Multicurrency Feature in Quick books (QB 12) 2012

Accounting

of Exchange Gain/Loss

Customers,

Suppliers, Banks having Foreign Currency

This

blog is about to understand foreign currency transactions and how can we enable

it in Quick Books 12. How can we assign currency to a customer, supplier, and

bank other than foreign currency? Let’s have a basic overview of it and how

accounting is automated in Quick books Enterprise Solution 12.0.

Basic Terms to Understand

this Concept:

Exchange

Difference:

It is

the difference resulting from translating a given number of units of one

currency into another currency at different exchange rates.

Exchange

Rate:

It is

the ratio of exchange for two currencies.

Fair

Value:

It is

the amount for which an asset could be exchanged, or a liability settled,

between knowledgeable, willing parties in an arm’s length transaction.

Foreign

Currency:

Currency

other than the functional currency of the entity.

Functional

Currency:

It is

the currency of the primary economic environment in which the entity operates.

Presentation

Currency:

It is

the currency in which the financial statements are presented.

Closing

Rate:

It is

the spot exchange rate at the end of the reporting period.

Spot

Exchange Rate:

It is

the exchange rate for immediate delivery.

How to Choose Currency whilst setting up new Company

In

quick books and any other Accounting and ERP Solution, you must choose

functional currency for the company that will never be changeable after its

selection. You do it while setup a new company database. All transactions will

be reported in the same currency in financial statements. But you can get

ledgers of customers, Suppliers etc. in foreign currency as well.

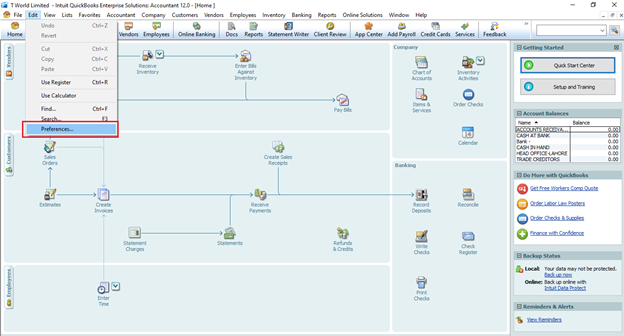

In

Quick books 12.0 you can choose currency in preferences and there in Multiple

currency section. Follow the navigation:

Go to à Edit Tab à Preferences à Company Preferences

Some

default options will be there, if your desired currency is not available in

list, you can find your home currency by activating the relevant one from

dropdown. Search the currency and activate to select the same.

How to select foreign Currency for Customers &

Suppliers?

I

shall guide here, how you can select foreign currency with customer while

creating a new customer, the procedure for supplier will be same. You must note

this thing that once you have selected any currency with customer or supplier

you cannot change if after having a single transaction against this

customer/supplier. You can change it only when you have not recorded any

transaction against these customers/suppliers. A new account with post fix of

this currency will automatically be created in chart of account of “Account

Receivable” type to post foreign currency transactions.

Foreign Currency

Transactions Recording & Exchange Gain/Loss Accounting

On

selecting such foreign customer/supplier on any input form like Sale Invoice,

Payment etc. some additional fields for exchange rate, foreign currency will

enable to put required information and here you can see on screen transaction

amount both in local and foreign currency after giving exchange rate of that

specific day. Exchange Gain/Loss will be calculated automatically when you put

exchange rate on “Sale Invoice” and “Customer Payment” forms, and

these exchange rates are different. This exchange Gain/Loss will be posted in

Exchange Gain/Loss account, created in chart of account.

Reporting

You

can get reports of customers/suppliers in both foreign as well as in local

currency of entity. By default, all reports will be displayed in Local/foreign

currency. You have to customize report to enable foreign currency and amount

columns, in this way you can have both amount columns on single report.

Customer Payment Transaction Recording and Exchange Rate

After

selecting foreign customer, put exchnage rate as guided in screen shot on the

day of payment. Rest leave on QB system to calculate and record respective accounting

entry for exchange gain/loss.

Please

note here the process is similar for supplier also same. Do record a “Bill” and

then “Pay Bill” with exchange rates on respective document and

transaction type day. Rest will be managed by the system.

Currency

can only be changed from supplier account until you record any transaction.

Once selected can never be changed.

See

Screenshot for Customer Payment

Foreign Currency Bank Accounts

An entity can have its bank accounts in multiple currencies

and wants to know balance in foreign currency also. You can create any bank

with any currency while creating new one. It goes the same way as

customers/Suppliers’ mechanism of creation. Consider these points while

creating new bank and using any bank in any transaction of customer/supplier.

§ Currency with bank account cannot be changed after

posting any transaction with that bank.

§ When you select foreign currency bank, new fields for

exchange rate will enable

§ Select exchange rate at the time of transaction

recording. (Ratio of local & Foreign CU amount)

Thank You!

Comments

Post a Comment

Thanks for your comment, will get back to you soon.